This page provides a basic overview of the key transfer processes.

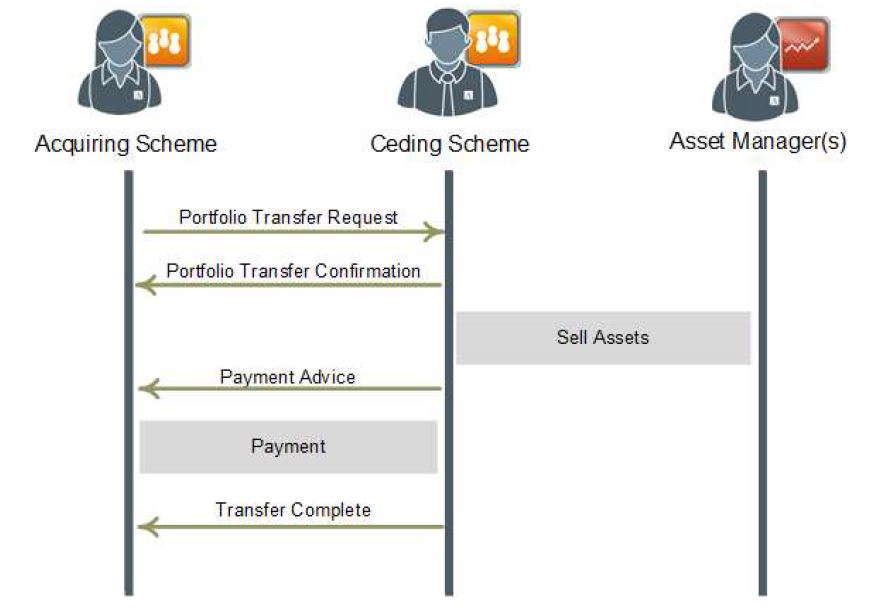

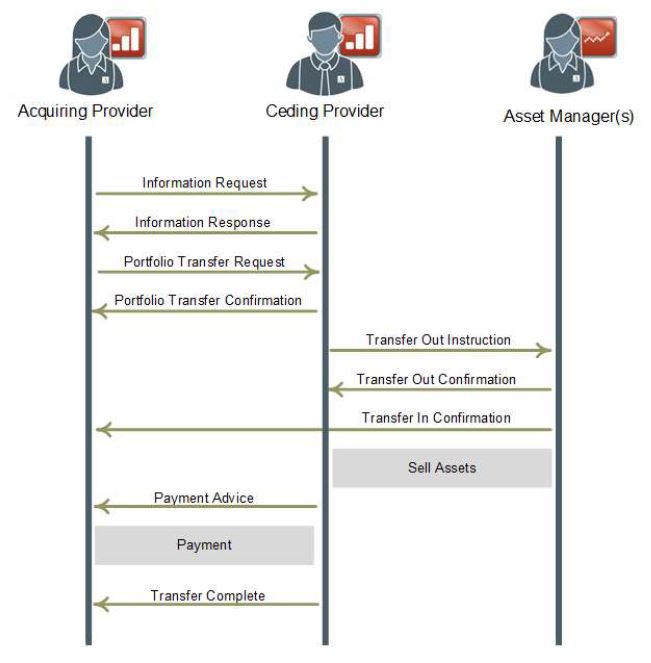

Cash Pension Transfer

- A simple cash pension transfer requires the ceding scheme to sell all assets in the account and transfer the cash to the acquiring party.

- The UKFMPG standards define message exchanges to instruct and confirm the transfer and provide details of the cash payment. The standards do not dictate how the assets are sold or how the cash is transferred.

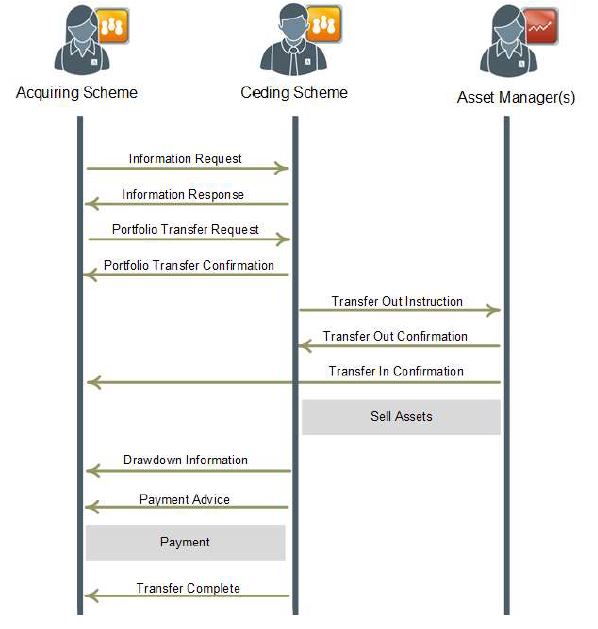

In Specie Pension Transfer

- A pension transfer where some or all the assets are to be transferred in-specie will typicallystart with a request to the ceding scheme to provide details of the assets held.

- Once the transfer details have been instructed and confirmed the ceding party will instruct assetmanagers to sell or re-register the assets.

- For funds, the re-registration will be instructed using the UKFMPG standards but other assets,such as equities, may use other mechanisms, for example CREST.

- If the pension is already in drawdown then the ceding scheme will provide the acquiring schemewith the necessary details of the arrangement.

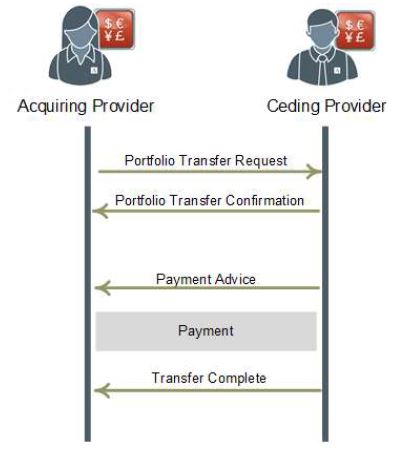

Cash ISA Transfer

- A Cash ISA transfer simply requires the ceding party to instruct and confirm the transfer and provide details of the cash payment. The standards do not dictate how the cash is transferred.

Stocks & Shares ISA Transfer

- The transfer of a Stocks and Shares ISA will typically start with a request to the ceding scheme to provide details of the assets held.

- Once the transfer details have been instructed and confirmed the ceding party will instruct asset managers to sell or re-register the assets.

- For funds, the re-registration will be instructed using the UKFMPG standards but other assets, such as equities, may use other mechanisms, for example CREST.

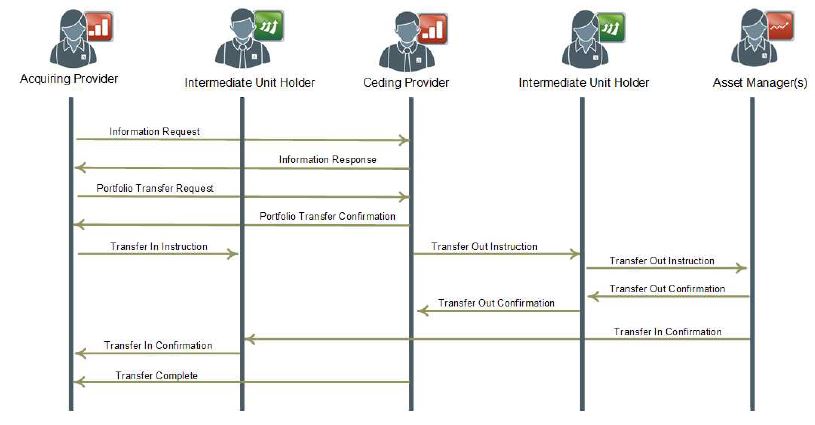

Intermediate Unit Holders

- Some providers employ an intermediate unit holder as a sub-custodian for assets (for example an institutional funds platform or broker).

- In this case, the acquiring or ceding party will issue instructions to re-register assets to the intermediate unit holder who will in turn forward the request to the asset manager.

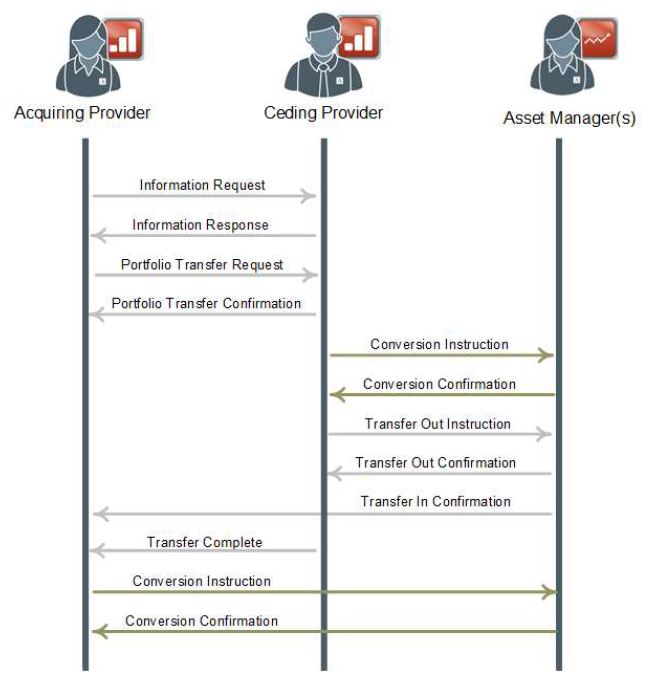

Conversions

- Where a fund is to be re-registered to the new provider but are currently held in a share class that the acquiring provider cannot hold (perhaps some discounted share class only available to the ceding provider) then the ceding party will convert the holding to a commonly available share class before initiating the re-registration.

- Similarly, after the transfer, the acquiring provider may convert the holding to some other share class that would be beneficial to the customer.

- Where an intermediate unit holder is involved the conversion requests will be chained down to the fund manager in a similar way to re-registration requests.